As personal auto insurance rates continue to accelerate upward, drivers are at a crossroads. Some are taking to the market to find cheaper rates—while others are choosing to drive without coverage.

Auto insurance premiums have increased at an unprecedented rate during the past two years, 7.9% in 2022, and another 5.9% in the first six months of 2023, according to JD Power’s Insurance Intelligence Report for September 2023, which found that an increasing number of insurance customers in the U.S. are finding they are no longer able or willing to pay for auto insurance.

The report found that the number of American households with at least one vehicle that say they do not have auto insurance has risen in the first half of 2023, up to 5.7% from 5.3% in the second half of 2022.

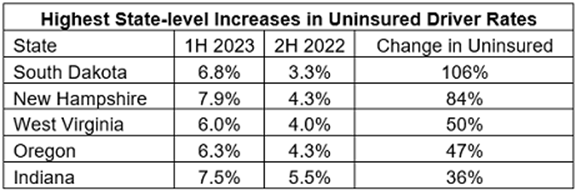

While an increasing number of drivers are uninsured, some geographical regions have a far higher concentration of risk.

In the first half of this year, 12 states have seen a 30% or more increase in the share of uninsured drivers compared with the second half of 2022, according to JD Power, and two of those states have seen increases of more than 80%.

Rising premiums have also encouraged drivers to shop for coverage, according to JD Power, as the percentage of customers who say they are shopping for auto insurance hit 12.5% through the second quarter of 2023, an all-time high.

Inflation, particularly in terms of claims costs, such as auto parts, labor and rental reimbursement, is pushing rates higher and making “customer defection an unavoidable problem for the insurance industry,” said the JD Power report.

“It’s certainly understandable that some customers would rather roll the dice than torpedo their monthly budget. But driving without insurance isn’t a long-term solution and often invites trouble,” the report said. “The conundrum, though, is that customers—particularly those who have not had any incidents in the past two years—simply see rate hikes. And if their driving record is clean, the hikes feel arbitrary and unjust.”

Unfortunately, more pain is on the way, with the property & casualty market not predicted to see loss ratios dip below 100% until 2025. In response to rising rates, the JD Power study outlined a few steps that consumers should take, such as asking their insurance provider or independent agent about changes they can make to their policies that could lower their premiums, such as changing deductibles or coverage limits and applying all eligible discounts.

“Drivers who remain insured should consider reviewing their uninsured/underinsured motorists coverage with an insurance professional,” the study concluded. “With more uninsured motorists on the road, ensuring proper coverage can offset some of the risks of being involved in a collision with someone who is not currently or adequately insured.”